Giving Money Away?

Tweeta version of this originally appeared on tokendaily.co, I still need to verify all edits match.

Give a Man a Bitcoin, and You Feed Him for a Day. Teach a Man To Mine Bitcoin, and You Feed Him for a Lifetime. – Ancient Proverb

Don’t snooze – many cryptocurrency projects are giving away coins for free – act fast and you can get some too! Whatever they call it: an airdrop, a share, a gift, a giveaway, etc, the idea is the same, noble intentions of correcting long-standing social iniquities by “giving money away” (in the form of cryptocurrency) to disenfranchised groups1. The disenfranchised group varies project-to-project; sometimes it is F/LOSS developers, sometimes all internet users, low-income individuals, etc.

There’s a catch that subverts this good intention – even ignoring difficult issues around identification of real users – it’s really hard to effectively correct these iniquities by giving away cash.

Plans that simply give out assets are misguided, because they conflate money with a different, though related, concept: wealth.

There are many ways to define these terms, but in this article I’ll define wealth as an individual’s ability to instigate changes that improve their current situation in some capacity. For example, I am wealthy if I know how to fix my own car when it breaks down. There are also harder to quantify forms of this wealth which only exist relative to a group such as leadership ability.

On the other hand, for this article, I’ll define money as a tool for convincing others of an individual’s wealth when they want something. For example, I could get a mechanic to fix my car in exchange a service or good of equal value – perhaps I can give the mechanic some advice on her ICO pitch deck – but in many cases it’s difficult to find something the other party wants, values equally, knows I have, or that I am able to offer currently. Instead, I give the mechanic a fixed amount of money, which is an easier to agree on means of exchange, unit of account, and store of value.

In another sense, money is a symptom of wealth. Where there is smoke, there is fire. Where there is money, there should be wealth. If one has a valuable skill, such as knowing how to rebuild an engine, one can use it to acquire money. While having money might be a good indicator that one possesses some valuable skill, you can easily imagine situations where this would be a false indicator – like lottery winners.

Giving money to a person lacking financial responsibility is unlikely to increase their wealth; like trying to use a cloud of smoke to start a fire. Lottery winners exemplify the challenge of converting ‘unearned’ money into wealth, about a third or more quickly go bankrupt despite their winnings2. Intuitively, if you wouldn’t invest in a slot jockey with your money before they hit the jackpot, what makes you think they’d do any better with their winnings?

Giving people wealth is more effective than giving them money. But is giving away wealth possible? And just how effective can giving away money truly be?

Let’s set those questions aside for a moment, we’ll revisit them later.

For now, we’ll construct a toy model3 for discussing giveaways. As with any model, this toy model is overly simplified for many reasons – I’ll do my best to clarify which things are simplified. The main purpose in presenting a toy model is to establish a common framework for how to think about giveaways.

Suppose we can represent everyone in the world’s assets as a vector \(v_a\) and their wealth as a vector \(v_w\). Assets are tangible things usable for transactions or ownership, and wealth is a measure of an individuals quality. For instance, a debit card uses assets and a credit card uses wealth.

We can model assets as a proxy for wealth, and model the efficiency of the proxy with a cost function such as Euclidean distance between the normalized vectors. We normalize the vectors to account for unit bias4, if everyone had $100 or $1M, it wouldn’t matter.

\[C_P(v_a, v_w) = \sqrt{(\hat{v}_m - \hat{v}_w)^2}\]In reality, Euclidean distance may be a really poor choice of cost function – perhaps a better choice is cosine similarity, perhaps there is a regularization parameter that says cost should be higher if the distribution doesn’t fall along a power law, perhaps Gini coefficient5 should be included, etc. But we will get a lot of mileage out of using a simple cost function for discussing the general shape of the problem.

I posit you can only meaningfully give people assets insofar as the giveaway works to minimize the cost function subject to a regularization parameter (otherwise our giveaway might be too radical, which could destabilize the economy). For example, the following formula is one possible giveaway cost function:

\[C_G(v_a, v_w, \Delta v_a) = C_P(v_a + \Delta v_a, v_w ) - C_P(v_a, v_w) + \eta \cdot || \Delta v_a||\]In plain English, you want the smallest giveaway for the largest correction in wealth/assets disparity. If \(C_G(v_a, v_w, \Delta v_a) > 0\), then you destabilize the monetary supply.

Again, this cost function is only offered as an example. We may also care about other regularizations against different types of giveaways – for instance, we might want to penalize giveaways that are ‘unfair’ with high variance between amounts – but we can use this model a starting point to look at a few examples.

If you want to follow along, the model is in python below:

def norm(v):

w = sqrt(sum(map(lambda x: x**2, v)))

if w == 0: return v

return [x/w for x in v]

def cp(m, w):

return sqrt(sum(map(lambda (a,b): (a-b)**2, zip(norm(m), norm(w)))))

def cg(m,w,dm, eta=0.01):

return cp([a+b for (a,b) in zip(m, dm)], w) - cp(m, w) + eta*sqrt(sum(x**2 for x in dm))

To work a quick, concrete example of correcting inequalities:

Suppose Alice has $10 and Bob has $20, but Alice is “worth” $10 and Bob is “worth” $12. I.e., \(v_a = [10, 20], v_w = [10, 12]\). To correct for the inequality, we either want Alice to have more money or Bob to have less. How bad is the current inequality? The cost function tells us \(C_P([10, 20], [10, 12]) \approx 0.23\).

Suppose \(\eta = 0.01\).

Let’s examine four plausible giveaways

What if we give everyone a small amount? \(\Delta v_a = [1, 1] \to C_G \approx -0.0046\)

Negative cost! It works! By increasing Alice’s and Bob’s assets, we made the overall efficiency of the monetary supply better.

What if we give everyone a lot!

\[\Delta v_a = [10, 10] \to C_G \approx 0.018\]Too much! Our money is less efficient.

What if we tax Bob a little and give to Alice?

\[\Delta v_a = [1, -1] \to C_G \approx -0.047\]What if we tax Bob a lot and give the tax to Alice?

\[\Delta v_a = [6, -6] \to C_G \approx 0.011\]What if we just destroy some of Bob’s assets?

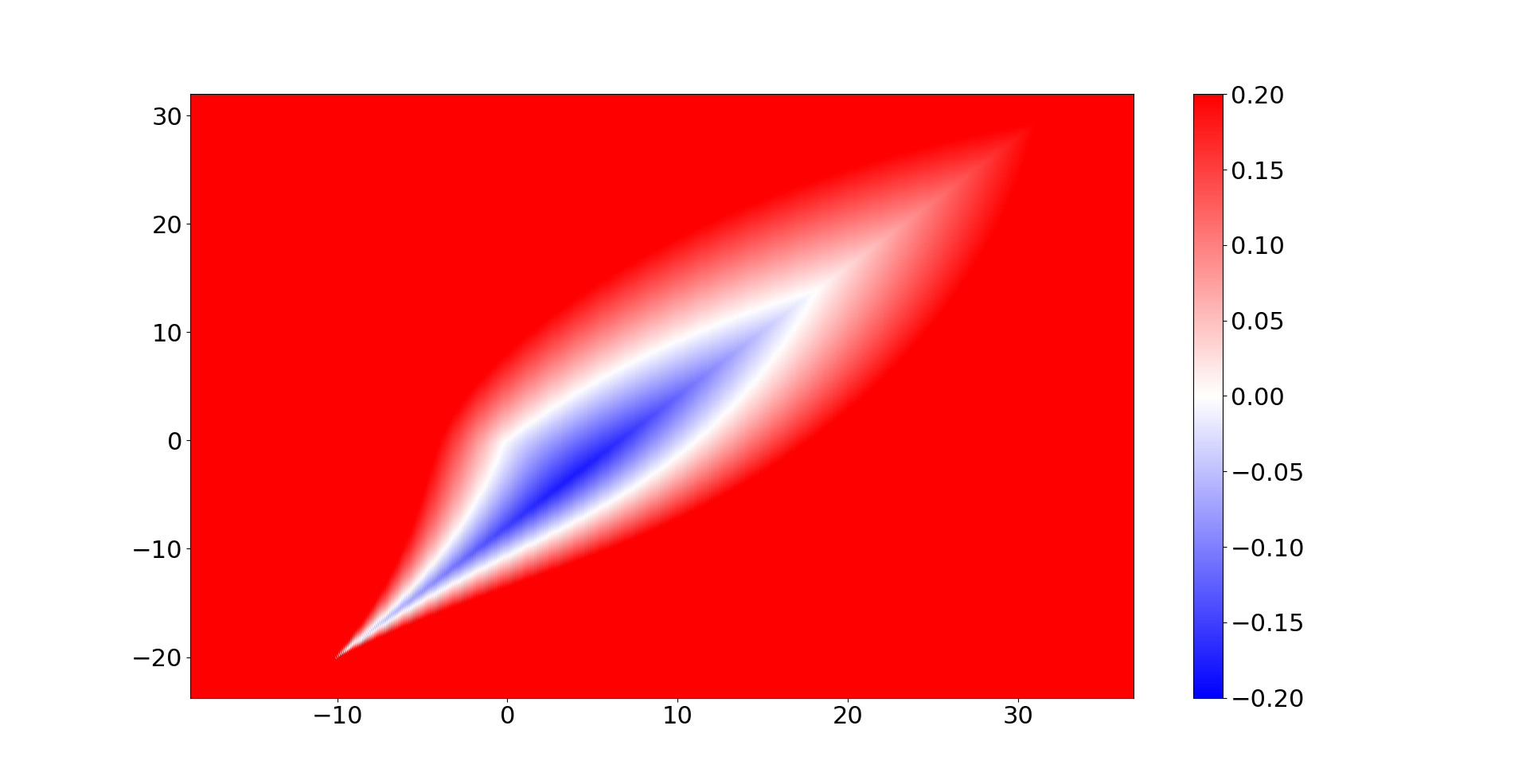

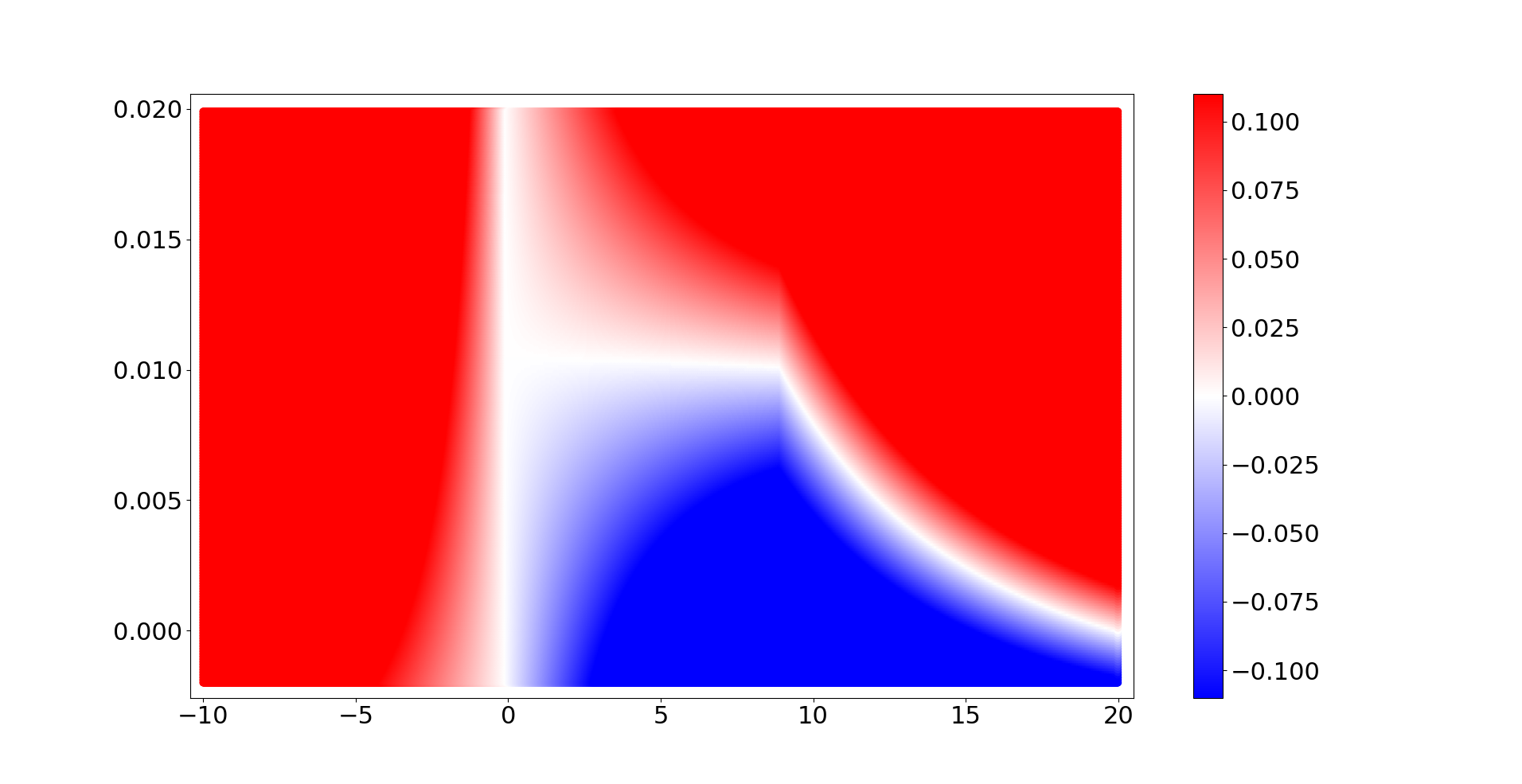

\[\Delta v_a = [0, -11] \to C_G \approx 0.023\]Let’s look at these examples as graphs. In the below graphs of giveaways, the blue areas are efficient, the red is inefficient, and the white areas are neutral. On the X axis is the amount Alice is to receive, on the Y axis Bob. Mind the scales on the right.

Nice – there is a large blue region where we can improve the inequality! This region is roughly a line segment from \((-10, -20)\) to \((18, 12)\).

In reality, in this model we might want to pick \(\eta\) such that the regularization amount is 1 if the size of the giveaway is the same as the monetary supply:

\[\eta = \frac{1}{||v_a||} = \frac{1}{\sqrt{10^2 + 20^2}} \approx 0.045\]

Now, the blue region is much smaller, and the maximum magnitude of the benefit is several orders of magnitude smaller. The giveaway doesn’t work that well!

Finding cost-reducing giveaways may be impossible in many circumstances (e.g., with a slightly greater \(\eta\)). This is always the case if the cost-function \(C_G\) is positive semi-definite with respect to the initial condition.

It bears repeating: this model is heavily simplified. In a real scenario, the regularization is much likely much larger.

Major wealth transfers often involve war, death, and destruction. Intuitively, if I stand to lose $M dollars, I am willing to spend $M dollars to prevent that loss (even if the total loss may be larger – see war of attrition6)

We also can’t simply find the blue-zones easily – ultimately, we don’t know how wealthy everyone is exactly and there are billions of people, not just two. Wealth is not a fixed quantity. Just giving someone assets doesn’t make them wealthier, nor does taking away some of their assets in the short term. In the long term, however, people’s wealth drifts and moves.

There’s been a lot of research that’s been done on the efficacy various forms of giveaway. Here’s a run down on 4 cases:

Example 1: Finland gave away 560 euros/month to 2,000 randomly selected unemployed Finns for two years. Finland didn’t find an increase in employment, but did find increased happiness. When the recipients base was slated to increase, unsavory side effects such as increased nationalism manifested7.

Example 2: GiveDirectly gives unconditional cash transfers to impoverished areas in East Africa. GiveDirectly claims to have seen a large improvement in the earnings of those who received unconditional cash transfers several years after the transfer8.

Example 3: The EU Africa Emergency trust, which is referenced in the Economist7, set up gifts to give to residents of countries which were below a certain poverty threshold if the government would share key reports and data. The program faced budgetary issues.

Example 4: GiveCrypto is a brand new initiative which gives crypto wallets with coins (unclear which ones) to those in need. This is substantial because cryptocurrency also helps fill in with banking infrastructure, unlike previous programs like GiveDirectly which relied on existing analog systems.

A problem shared across these studies broadly is that they are not large enough. The amounts of money dispersed is significantly smaller than the magnitude of inequality between the sponsors and the recipients. Performing such socioeconomic experiments at scale may self destruct an economy and society unwilling to bear the cost of a non-experiment sized giveaway. Increasing nationalism, as seen in Finland, could be a precursor for increased violence or decreased long term global development.

A second issue is that these programs are targeted at increasing wealth, not decreasing inequality. As is often said, a rising tide raises all boats. If the global economy improves as a result of assisting impoverished individuals, the benefit is not clearly greater for the receiver than the giver. For instance, the giver may benefit greatly from having new agricultural trade, sources of cheap educated labor, advanced manufacturing capability, or from increasing peace in troubled regions defraying the risk of costly wars.

A third concern is that such programs create subversive reliance. For instance, in Gambia, when politicians wanted to stop passing on surveillance data to the EU, which would end the payments, mass protests erupted. The Gambian citizens were put into a precarious relationship with the EU, whereby the EU had the power to influence their politics and conduct – perhaps against their longer term interests. This emphasizes the importance of unconditionality, as promulgated by GiveDirectly. Unfortunately, the discretion to continue or not continue a giveaway itself constitutes a conditionality. It’s best to structure programs so as to minimize the chance of dependence or economic reliance for the independence and freedom of the recipients.

Let’s look examine some strategies in light of the real world research and our model.

Give Small Amounts, Frequently

Giving away a large amount should be mostly infeasible because of regularization. However, by giving away small amounts repeatedly, we have an opportunity to re-examine the money to wealth ratios for each individual, and we also give the money distributed a chance to impact wealth. This is reminiscent of gradient descent as used in Machine Learning9.

The down side is that if the distributions are too small then the economy can sufficiently absorb and dissipate the extra money without benefiting anyone, and if they are too frequent then it may not be different than a single larger giveaway, causing chaos.

Target Specific Groups with Bad Wealth : Assets Ratios

One way to improve the odds of our distribution working is by finding small communities with bad money to wealth ratios and focusing on them exclusively. This is essentially the GiveDirectly model for working in East Africa.

However, we must be careful. Because of the normalization of the assets vector, giving money to one person fundamentally takes money from everyone else.

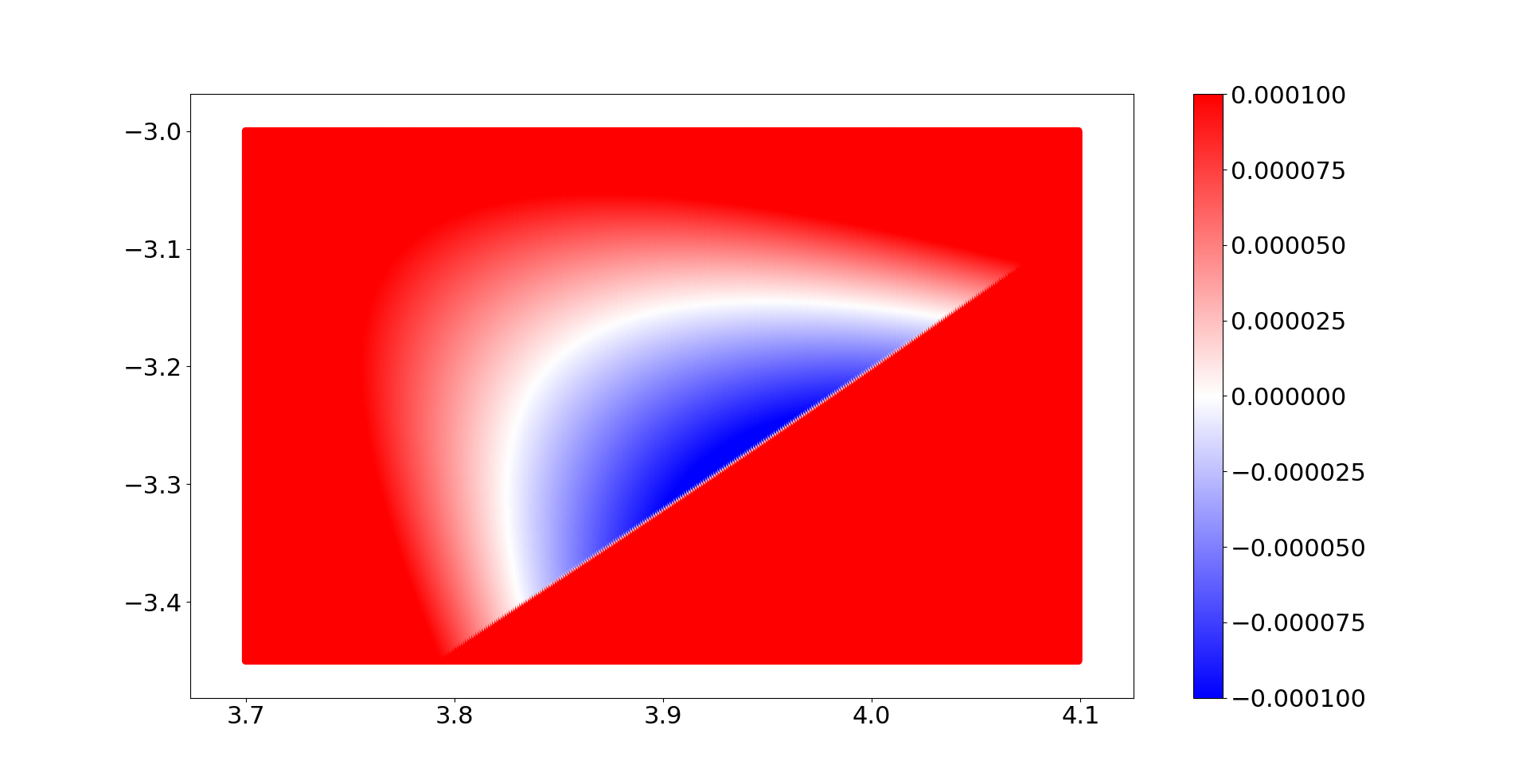

Shown below, 90 people with 10 wealth and 10 assets each, and 10 people with 10 wealth and 1 assets each. We give all 10 asset-poor people X assets each. Y is \(\eta\), the learning rate.

This shows us that there is a range of reasonable giveaways, so long as we discount giving money heavily (above \(\eta \approx 0.01 \) everyone is made worse off giving away any money).

It’s also critical to ensure that this is somewhat Pareto Efficient – if increasing the wealth of one group puts them on par or above another, that other group may suffer. For instance, if supporting a poor community results in a flood of agricultural products, existing farmers quality of life may be made worse.

Self Determination & Currency Competition

One way to improve the efficiency of the money supply is to allow people to issue currencies at will for whatever group wants to.

The price discovery process for this currency on the open market serves as a feedback loop for if that distribution formed a good giveaway or not and the integrity of those who operate and hold the new currency.

Internally to the group self-determining, the new currency should be viewed as more efficient among the group itself.

In a parallel world, instead of GiveCrypto, there’s GiveLiquidity which buys and sells cryptocurrencies issued by communities to help them bootstrap internationally. This would help avoid colonialist influence because communities would have more autonomy over the new money supply they are adopting.

Increase Wealth Directly

This is a bit of a trick. Recall, our cost functions from our toy model are about optimizing our money supply – not our overall outcome.

Individual wealth can increase directly without a gift of assets. For instance, sponsoring educational programs is a way to increase the wealth of society – this is commonly done through subsidized school programs. There’s evidence that shows that unconditional cash transfers increase attendance at schools more than conditional transfers, but improving the quality of education available could provide an even larger boost.

Another take on this is to remove “wealth-conversion depressants”. An example of this is hair stylist licenses10, they ultimately serve as a barrier for entry based on assets available (not based on skill).

Counteracting Another “Giveaway”

If other contemporaneous events emulate a giveaway that redistributes assets in such a manner that there is a substantial worsening of wealth to assets ratio, a concurrent giveaway could counteract this. Two examples of this are giving resources to educated refugees and asylum seekers who left behind their property and assets (the conflict is reassigning their assets via violence) as is being done in Turkey11 and proposals to use Bitcoin in Venezuela to counteract the instability of the Bolivar12.

In writing this article, my hope was not to convince you that you can’t make people’s lives better – au contraire! Working to improve the human condition is something that each and every one of us should do every day, and I laud those trying, even if I disagree with their tactics.

I do hope that you are left understanding how difficult it is to give away money with good effect. Fully fixing the inequality would cause massive upheaval and disorder, increasing the fairness but decreasing the wealth. Peer reviewed experiments with promising results are unlikely to scale because they don’t run up against this societal regularization. They also, at scale, may cause an untold loss of liberty as more income is unearned and dependent on the discretion of the ruling class.

I’ll leave you with this: In setting up the dichotomy between wealth and assets, I’ve completely side-stepped the much more interesting question: wealth inequality. Is it an issue if someone else is, by natural virtue, exponentially better off than me? Should that inequality be rectified? Can it be? When a new disease breaks out, the immunologist’s value to society increases, maybe that’s how it should be. Maybe we could all attain equal wealth at the cost of our individuality. Or perhaps we could all be equal, but none great. Maybe our best bet is for each of us to ask, are we better off than we were before; and what can we do for those of among us who are not as fortunate?

-

disclosure: I am an advisor to Stellar, which aspires to give away cryptocurrency to many people. ↩

-

This model is inspired by general format of a gradient descent problem. ↩

-

Accounting for the fact that there could be X ‘dollars’ per unit wealth. ↩

-

A measure of centralization of wealth distribution. See the wikipedia entry. ↩

-

Two great interactive sites demonstrating these methods, one and two. ↩